Stripe Tax is a paid add-on for Stripe that helps you automatically calculate and collect the correct amount of tax when your subscribers checkout, and access the reporting you need to file returns.

Getting Started

In order to use the Stripe Tax integration, Stripe Tax must first be enabled and setup from within your Stripe Dashboard, prior to the beta being turned on in Ghost.

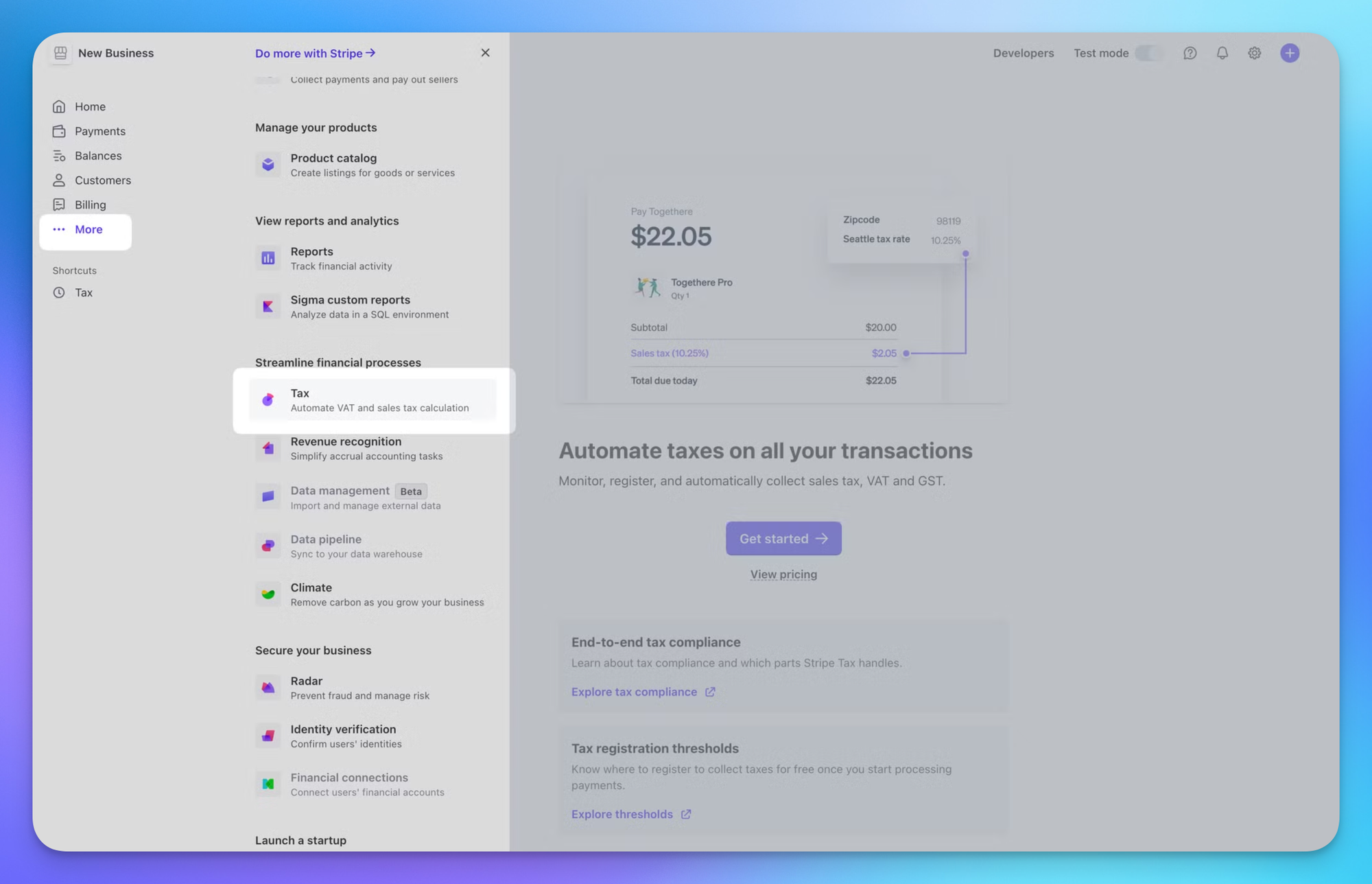

Step 1: Enable Stripe Tax

Navigate to the Tax section of the Stripe Dashboard, and click “Get started →”

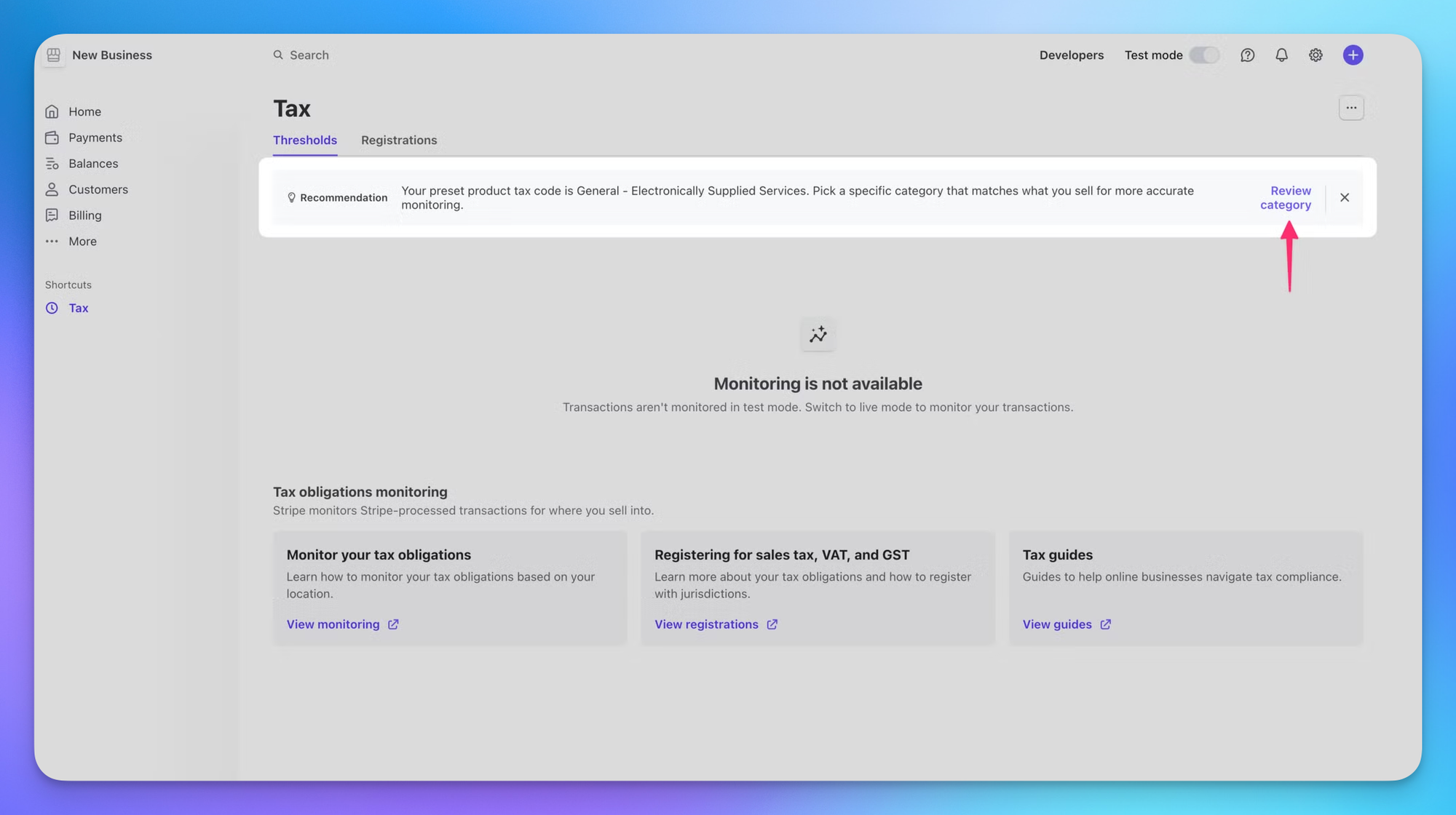

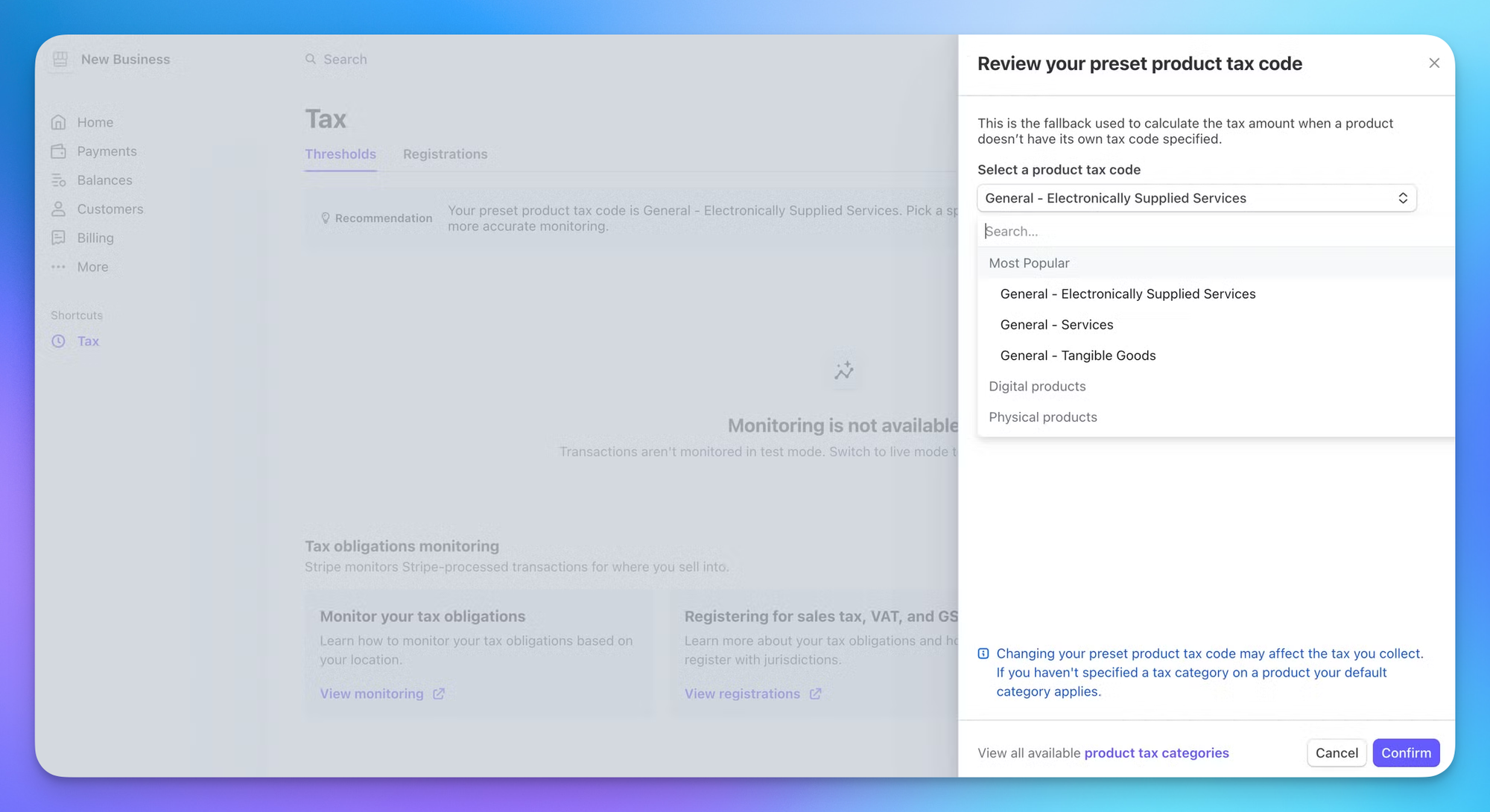

Step 2: Select a preset product tax code

Once you’ve entered the setup screen, you’ll be prompted to review your product tax code category.

From here, you can choose the product tax code that makes the most sense for your business. The default will always be set to “General - Electronically Supplied Services.”

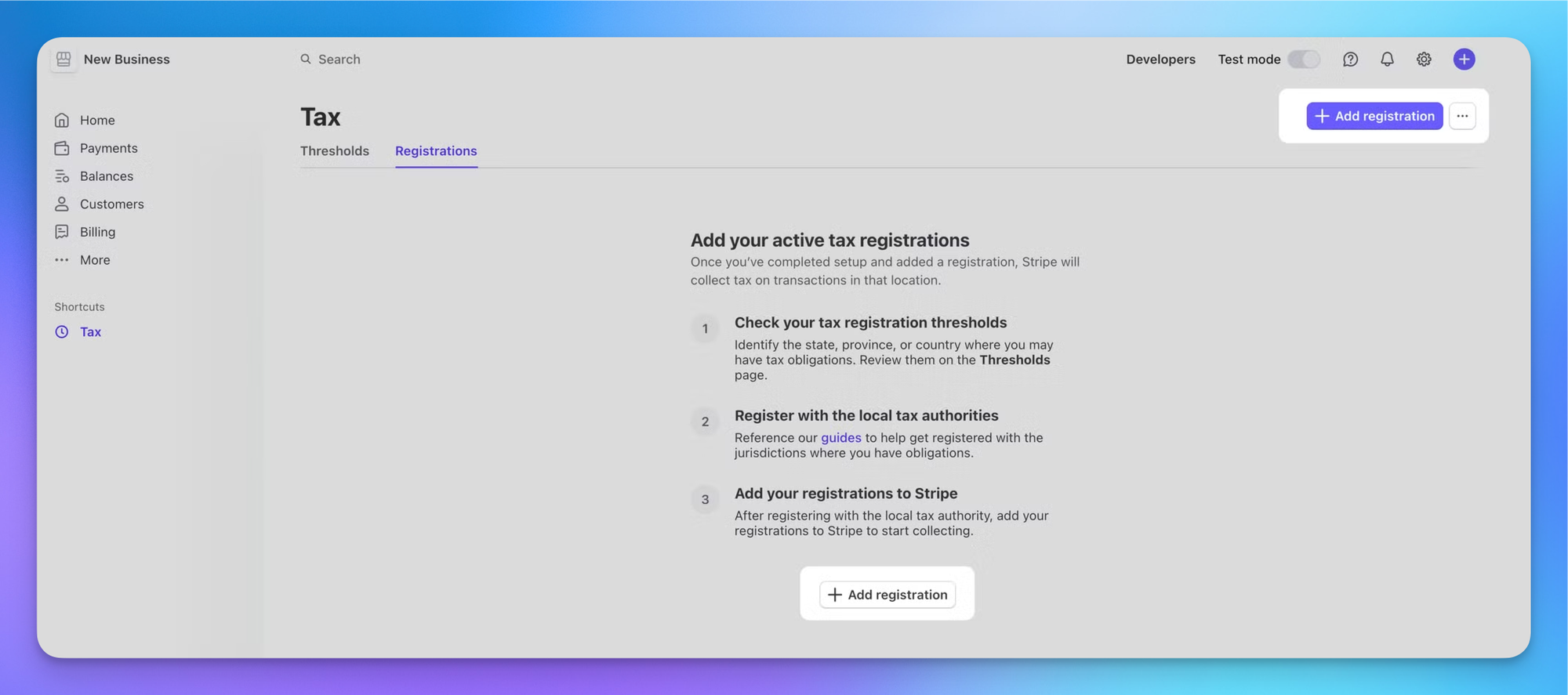

Step 3: Add a registration

If you’ve exceeded a threshold in a certain state, province, or country, you’ll need to register with the local tax authority prior to adding your registration to Stripe.

How do I know where to register?

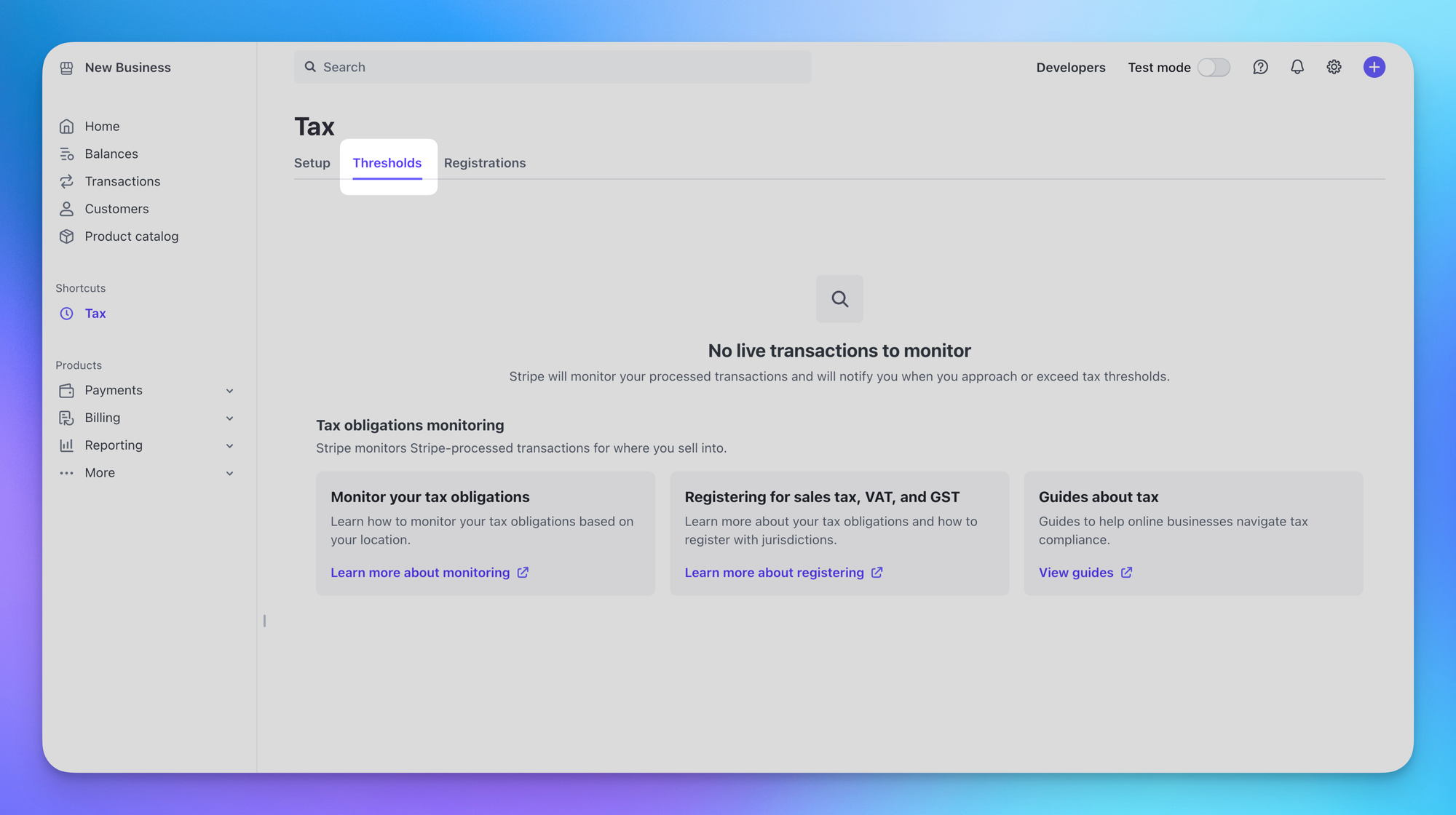

If you’re setting this up, you may already know one or two places where this will be required, but figuring out the rest isn’t always easy. Stripe helps you identify the correct places based on your past transactions with their Thresholds tool:

Once done, you can add your registration(s) to Stripe from the Tax dashboard:

Step 4: Contact Ghost to turn on the integration

For Ghost(Pro) customers, once everything is setup within your Stripe account, contact support@ghost.org and our team will manually enable the integration on your account.

I’m a developer, self-hosting my own Ghost instance. How can I try out the beta?

Once the above setup steps have been taken to enable the Stripe Tax add-on in Stripe, those self-hosting Ghost can enable the beta integration in their config.production.json file by adding "stripeAutomaticTax": true in the labs object:

{

...

"labs": {

"stripeAutomaticTax": true

}

}How do I know it’s working?

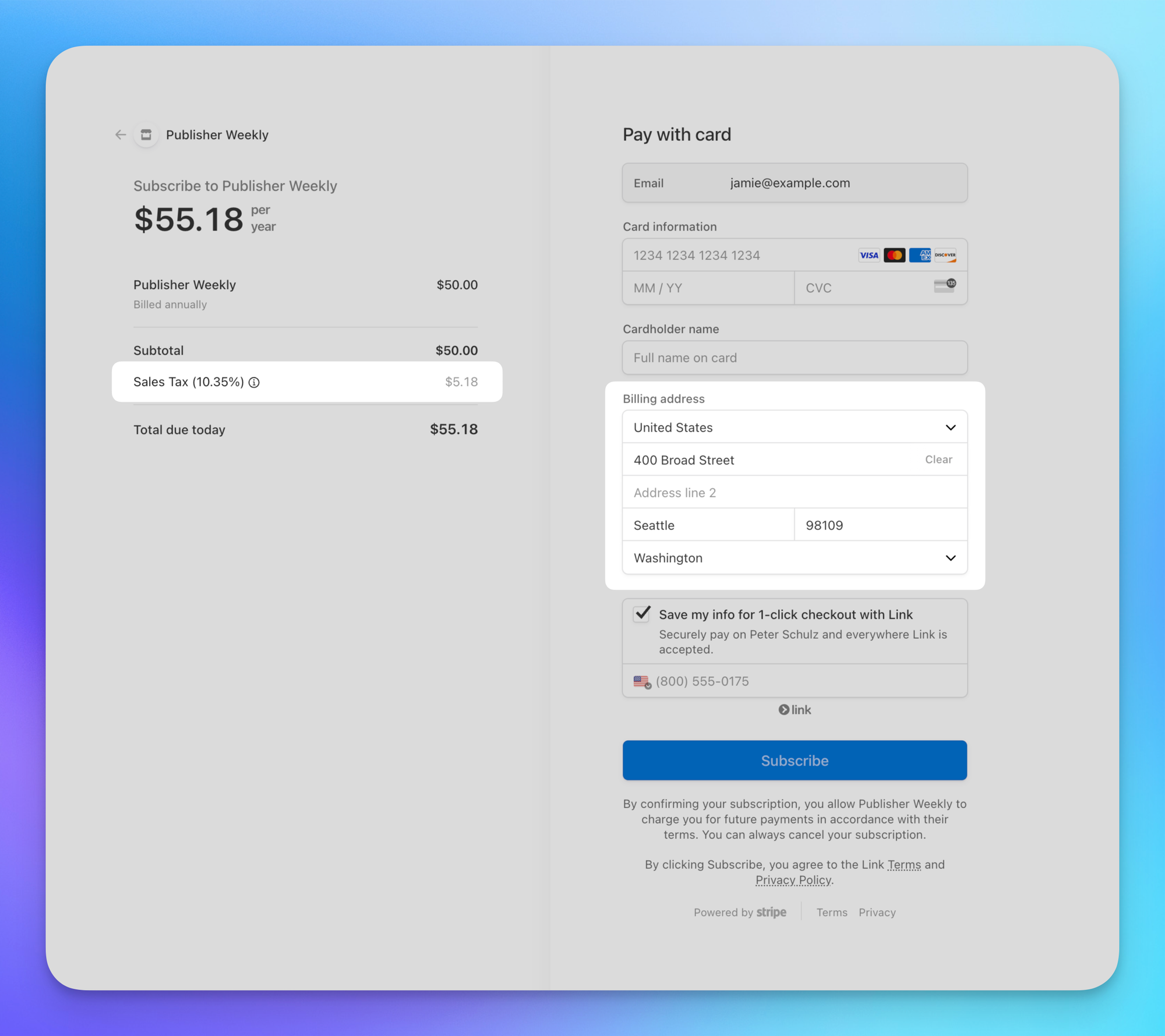

Once enabled, members going through Stripe Checkout will see an additional field to enter their address. If they live in a location in which you’re registered to collect tax, it will be automatically calculated at the appropriate rate for any active tier in Ghost:

Reporting

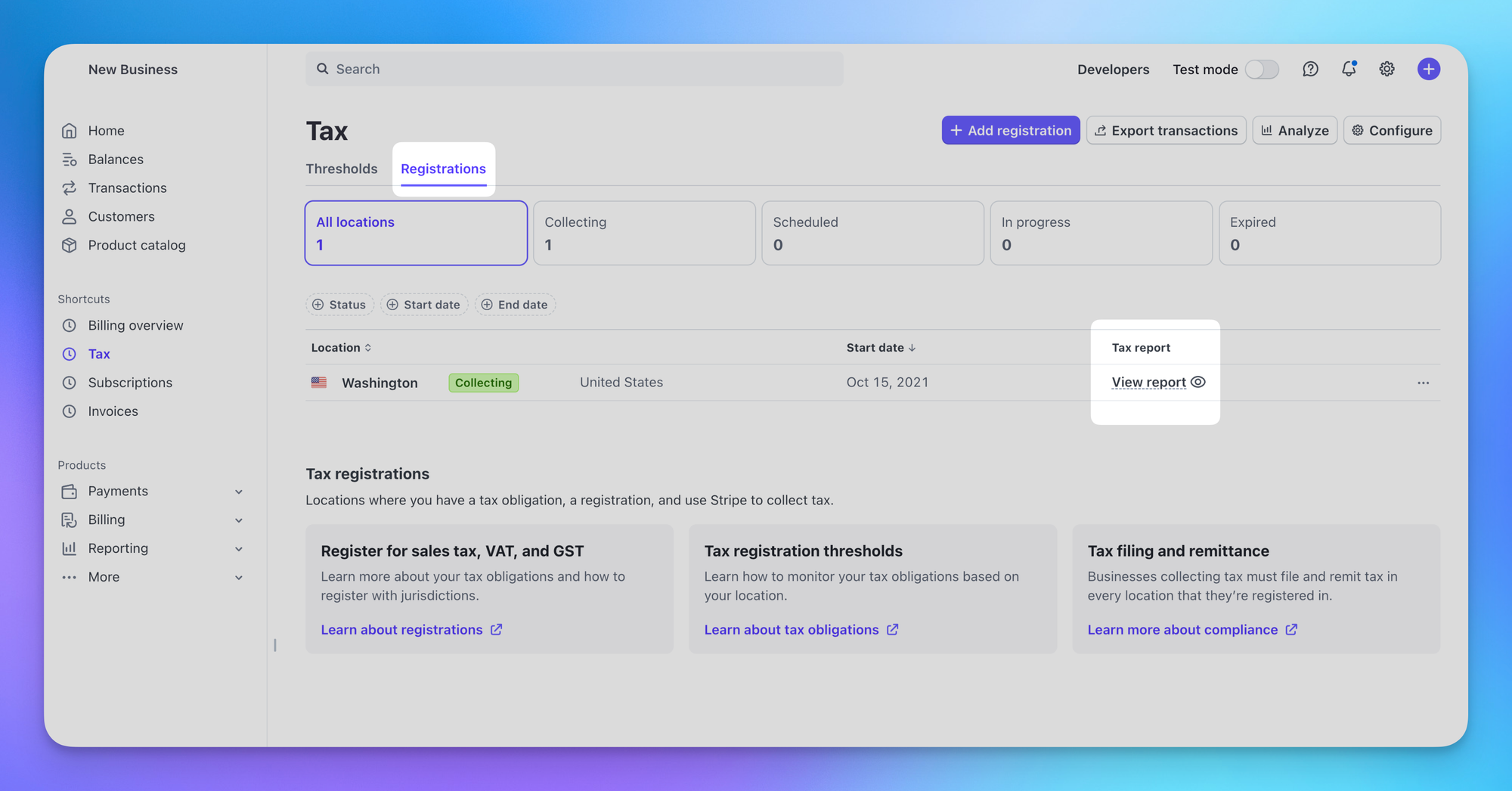

Once the integration is up and running, you’ll be able to access reporting for each of your registered jurisdictions directly inside Stripe in the Tax section of the dashboard.

Stripe Tax FAQ

Does Stripe remit my taxes for me?

No, Stripe does not remit your taxes for you. You can learn more about filing and remitting when using Stripe Tax here.

Will my existing paid members, created prior to Stripe Tax being turned on, also now have taxes applied to their accounts?

No, only newly created paid members will have the tax rate applied to their subscription.